Table of Content

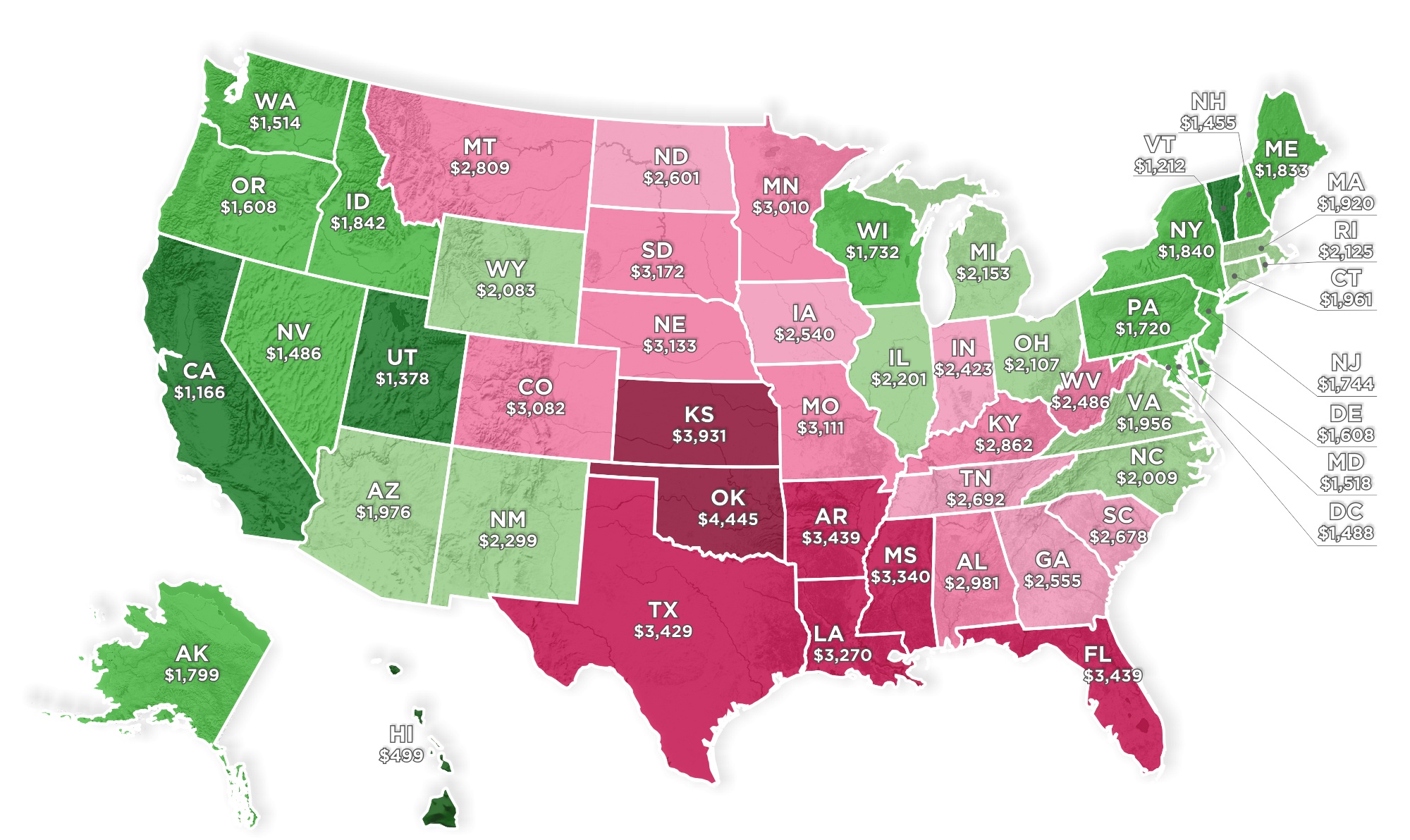

American Modern offers vacant home coverage and will take on risks other companies will turn down, including owners with bad credit. Claims history, location, and coverage limits are some of the factors that influence mobile home insurance rates. Mobile home insurance is known in the industry as an HO-7 policy. The average cost of mobile home insurance varies between $300 and $1,000 per year, depending on where you’re located. Our complete coverage package can help you pay for a new mobile home of similar style and cost if your newer mobile home is destroyed by a covered loss.

Replacement cost covers any damage incurred on your mobile home, personal property, and/ or other structures. There are 4 main coverage features that are crucial to the foundation of a sound mobile home insurance policy. When considering different options, ensure that each and every one of the following are included. However, it usually requires a unique form of insurance rather than a standard homeowners insurance policy since it has significant structural differences.

American Modern (AMIG)

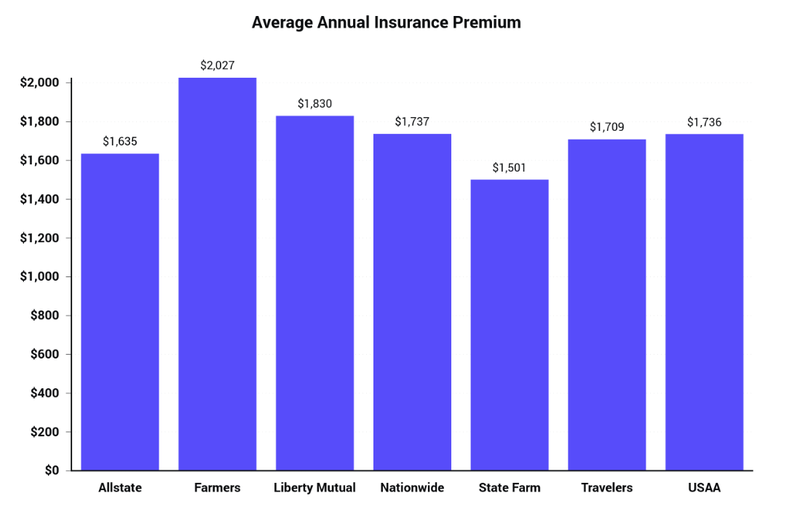

Founded in 1931 and based in Northbrook, Ill., Allstate is one of the country’s largest insurance companies. Founded in 1937, Progressive is one of the largest insurance companies in the country. You will have to buy a separate policy for flood coverage, usually through the National Flood Insurance Program. The value of all of your personal property, from your TV to your towels. Covers injuries or damage for which you or a household member are responsible. Individual must be a registered representative of FBL Marketing Services, LLC or an investment adviser representative with FBL Wealth Management, LLC+ to discuss securities products.

Weather is, of course, a huge factor, and the severity of certain conditions will help to drive specific types of coverage. Protect your home against windstorms, falling trees and objects, hail storms, and a host of occurrences that manufactured homes are usually more susceptible to. These occurrences are most often minor, but the cost to repair can put a serious dent in your budget.

Farmers

Insurance policy is with to find policy service options and contact information. With just a few clicks you can access the GEICO Insurance Agency partner your boat insurance policy is with to find your policy service options and contact information. Pays to repair a fence, shed or other structure that isn’t attached to your home if it’s damaged by an event your policy covers. Pays for personal property while it is in your home or anywhere else in the world in the event of a covered loss. That said, it’s important to look at both your protections and the price of the premium. Sometimes spending a couple of bucks more every month will save you from a big headache in the future.

Provides additional coverage for expensive items such as appraised jewelry, collectibles or antiques. The American Family Insurance only underwrites manufactured homes in 19 states but provides unique endorsements such as matching siding. The coverage costs as little as $25 per year but will reimburse you for up to $20,000 to replace all siding, instead of a small area, so it all matches. Below, we’ve listed some of the best picks so you can shop, compare and find the best mobile home insurance for your needs. If you choose to bundle your mobile home and auto insurance policies, you can save up to 25% on your premium.

What are the best mobile home insurance companies?

You can also typically add coverage from most providers for identity theft protection and replacement cost coverage, but each provider offers its own unique array of endorsement options. Mobile home insurance is similar to a standard homeowners insurance policy. Mobile or manufactured home insurance is not required by law, but a mortgage company and/or mobile home community may require homeowners to purchase coverage. American Family offers standard coverage damages from fire, theft, vandalism, and other covered perils, personal liability, loss of use, and medical payments if a guest is injured on your property. Policyholders have the option of adding optional coverages, such as ones for hidden water damage, matching siding endorsement, trip collision coverage, and property coverage for other structures.

Progressive’s coverage includes protection for your dwelling in case of fire, hailstorm, theft, vandalism, explosions, and other covered perils. It also includes actual cash value for personal property, loss of use coverage, and liability coverage. Homeowners can also add on trip collision coverage and replacement cost coverage, though these vary from state to state. Mobile home insurance is also known as manufactured home insurance, depending on the policy and type of home, and is much like any other homeowners insurance policy. It covers the dwelling, your personal property and offers liability protection. These coverages can be accessed during a claim from a wide range of covered events or perils, such as a fire, snowstorm, severe thunderstorm, burglary or theft.

Progressive quote was way up there 6k i think, geico subs it to assurant we you do it online ,that is who we have it with now but it is still $4000/year and only covers the house for 30k and content 15k. No way we could replace this double wide for 30k cost close to 9k just to move one, we just moved this one here last year. We just requested a quote from foremost to see what their price is. We are debating now on just dropping it all together and put the money in savings and get the content only coverage through state farm with is like $30/month. We used to have coverage on a 200k house in this area and paid 2k/year. This insurer offers the usual discounts, such as ones for bundling policies, enrolling in autopay, installing safety devices , being a loyal customer, and new homes.

So, how do you know what kind of coverage you need, and what will it cost you? Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy.

Since pricing varies depending on each situation, we recommend getting quotes from a few options to compare premiums and coverage offered specifically to you. However, if you don’t want the confusion of working with a third-party insurer that underwrites your mobile home insurance policy, Progressive may not be your best option. Because of the way they are made, many mobile and manufactured homes are not as durable as a traditional stick-built home mainly because they are not securely anchored. Their weight makes them weak in resistance to high winds and floods. When you click on the "Start Quote" button or "mobile home insurance quote" link you will be taken to a site owned by Assurant, not GEICO.

She is the founder of Beyond the Dollar, a podcast aimed at making normalizing talking about personal finance and money topics. Ensures that your items are replaced at the current price to replace them, rather than the depreciated value. Covers water damage caused by a broken sump pump or backed-up drain. The furnace you choose for your mobile home will function differently compared to furnaces designed for traditional...

In other words, some companies will only cover on an actual cash value basis for partial losses or only on a replacement cost basis for major damages or total losses. Some insurers also offer the choice to upgrade to replacement cost for your entire policy for an additional cost. There may also be coverage specific to mobile homes, such as trip collision coverage to protect your home against repairs if it’s damaged while moving between locations.

Among the options are specialty insurance companies like Foremost. Since J.D. Power doesn’t rate smaller insurance companies, no rating is available. Manufactured or mobile homes are the same; the term manufactured home came into use in 1976 to denote new manufacturing standards. Customers can save up to 15% on their policy if they have systems in place that add more protection to their homes such as fire alarms and security cameras. Furthermore, materials used to construct mobile homes are lighter than that of traditional houses. This puts them at more risk of needing repairs after harsh wind, especially if the home is not anchored to the ground.

Flood damage is not traditionally covered by the average homeowner’s insurance policy. However, most mobile homes usually qualify for this due to the nature of their structure and vulnerability to harsh environments. As a result, it outperformed all other companies in our in-depth review, scoring a 4.84 out of 5.

No comments:

Post a Comment